Fox & Partners has revealed that there has been a steep 61% rise in complaints to the Financial Conduct Authority in the last year about the way that financial institutions handle allegations of malpractice by internal whistleblowers, suggesting that companies’ procedures need reviewing, particularly in the banking sector. You can read the full press release below, and you can read coverage of our research in Financial News and the ‘i’ newspaper

61% jump in complaints to FCA about poor whistleblowing procedures in financial services sector

- Concerns amongst employees about whistleblowing procedures being ignored

- Obligation on Senior Managers to report concerns

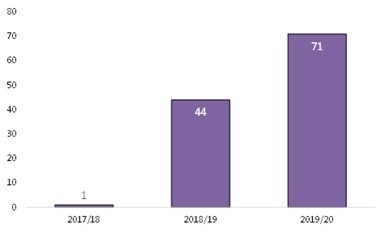

There has been a 61% jump in complaints to the FCA from individuals concerned about the whistleblowing procedures at their firms to 71 complaints in the last year*, up from 44 the year before, says Fox & Partners, the specialist employment and partnership law firm.

Fox & Partners says that concerns have grown amongst staff over whether issues they raise will be handled effectively by senior executives. Other key concerns include whether the anonymity of the whistle-blower will be assured and if there are protections in place to prevent victimisation of that member of staff.

The FCA has found that some of these issues are prevalent amongst banks in particular. A 2018 review noted most banks needed to ensure there was a more consistent approach to assessing and escalating issues raised by whistleblowers**.

There has been growing scrutiny of whistleblowing procedures at financial services firms following a high-profile case in 2016 where the CEO of a FTSE100 bank tried to unmask the identity of a whistle-blower. The FCA personally fined this CEO almost £650,000.

A key feature of the Senior Managers Regime is the appointment (from 7 March 2016) of a “whistleblower champion”. The FCA stipulates that this person should be a non-executive director, if there is one, but must be a director or Senior Manager. This person is responsible for overseeing the integrity, independence and effectiveness of whistleblowing policies and procedures. The introduction of personal regulatory responsibility may be driving individuals at senior levels to raise concerns about their internal whistleblowing procedures that they might otherwise have previously kept quiet about.

If the FCA finds evidence a firm or individual has acted to the detriment of a whistleblower then this may call into question their fitness and propriety. This could result in a firm losing its authorisation and an individual their approved status, which would be very damaging.

Ivor Adair, Partner at Fox & Partners, says: “A growing number of employees in financial services think the whistleblowing procedures at their firms are not working as they should do and don’t properly protect whistle-blowers.”

“Making the decision to blow the whistle on internal problems and wrongdoing is often a very difficult one to take. Whistleblowers need to have confidence that the procedures designed to protect them are fit for purpose; if they are not, the procedures themselves are a further deterrent to raising concerns of malpractice in the public interest. Firms ought to ensure their whistleblowing procedures are regularly reviewed and their effectiveness tested.”

Number of complaints to the FCA about the whistleblowing procedures has jumped 61% in the last year – number of complaints

* Year-end June 30 2020, based on data provided by the FCA

**FCA, Retail and Wholesale Banking: review of firms’ whistleblowing arrangements